Some Of Feie Calculator

All About Feie Calculator

Table of ContentsGetting My Feie Calculator To WorkAn Unbiased View of Feie CalculatorFeie Calculator Can Be Fun For AnyoneIndicators on Feie Calculator You Should KnowGetting My Feie Calculator To WorkThe Best Strategy To Use For Feie CalculatorRumored Buzz on Feie Calculator

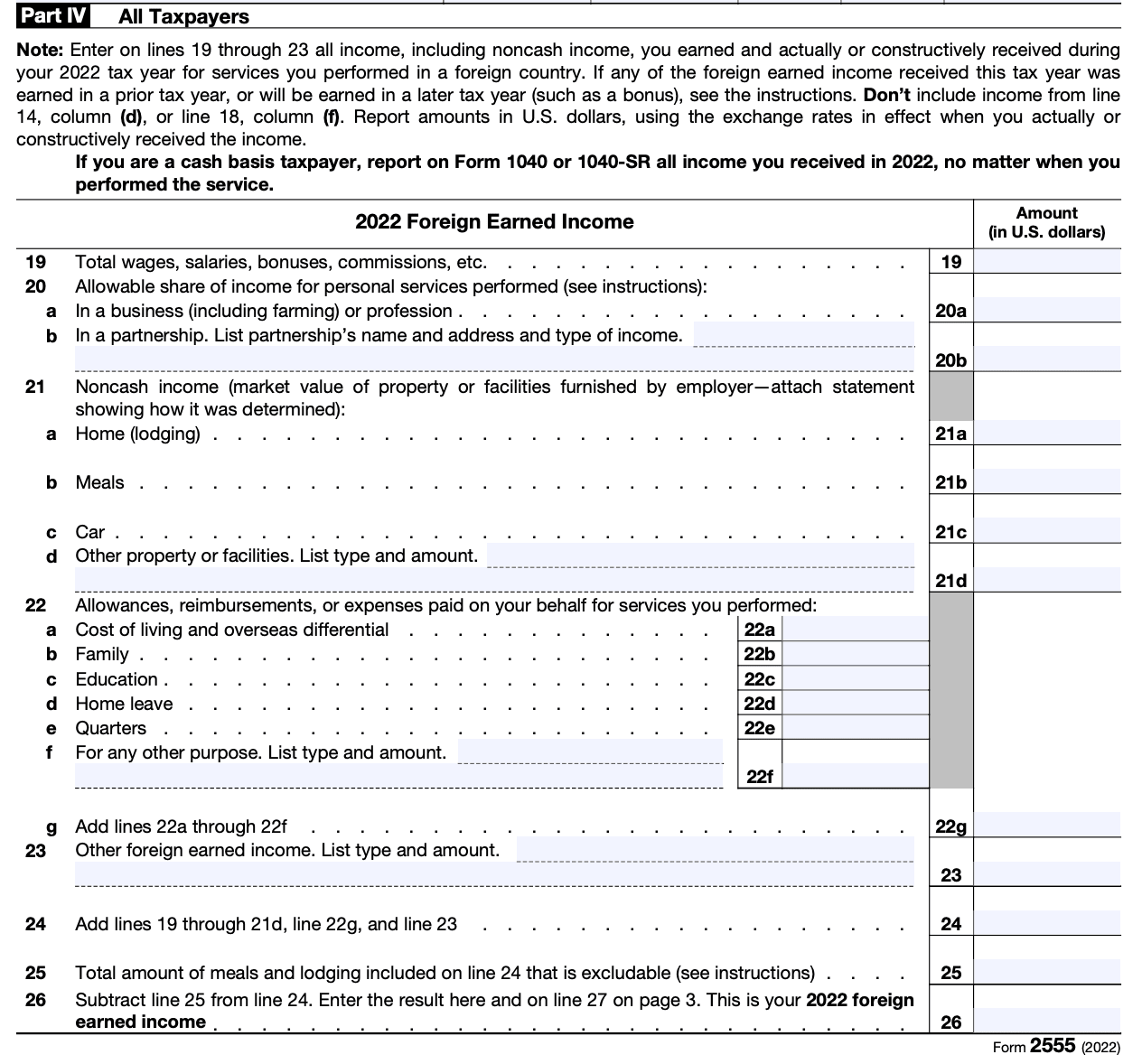

If he 'd frequently taken a trip, he would rather finish Component III, detailing the 12-month duration he fulfilled the Physical Existence Examination and his traveling history - Physical Presence Test for FEIE. Step 3: Reporting Foreign Income (Part IV): Mark made 4,500 per month (54,000 each year). He enters this under "Foreign Earned Earnings." If his employer-provided housing, its worth is additionally included.Mark computes the exchange rate (e.g., 1 EUR = 1.10 USD) and transforms his salary (54,000 1.10 = $59,400). Considering that he resided in Germany all year, the percentage of time he stayed abroad throughout the tax is 100% and he enters $59,400 as his FEIE. Mark reports total incomes on his Type 1040 and enters the FEIE as an adverse amount on Set up 1, Line 8d, reducing his taxed income.

Choosing the FEIE when it's not the very best choice: The FEIE might not be optimal if you have a high unearned revenue, earn even more than the exemption limitation, or stay in a high-tax country where the Foreign Tax Debt (FTC) may be extra helpful. The Foreign Tax Obligation Credit Scores (FTC) is a tax obligation decrease approach usually used along with the FEIE.

An Unbiased View of Feie Calculator

deportees to counter their united state tax financial obligation with international income taxes paid on a dollar-for-dollar decrease basis. This suggests that in high-tax countries, the FTC can often remove united state tax obligation financial obligation entirely. However, the FTC has limitations on eligible tax obligations and the optimum insurance claim amount: Qualified tax obligations: Only income tax obligations (or tax obligations instead of revenue taxes) paid to foreign governments are qualified.

tax obligation on your international revenue. If the foreign tax obligations you paid surpass this limitation, the excess foreign tax can typically be brought onward for as much as 10 years or returned one year (using a modified return). Maintaining precise documents of foreign revenue and taxes paid is as a result important to calculating the correct FTC and preserving tax obligation compliance.

migrants to lower their tax obligation obligations. For example, if an U.S. taxpayer has $250,000 in foreign-earned revenue, they can exclude approximately $130,000 making use of the FEIE (2025 ). The continuing to be $120,000 may after that undergo taxes, however the united state taxpayer can possibly apply the Foreign Tax Credit scores to balance out the taxes paid to the foreign country.

The Facts About Feie Calculator Revealed

He offered his U.S. home to establish his intent to live abroad completely and used for a Mexican residency visa with his wife to aid satisfy the Bona Fide Residency Examination. Furthermore, Neil secured a long-term residential or commercial property lease in Mexico, with plans to at some point acquire a property. "I presently have a six-month lease on a residence in Mexico that I can prolong an additional six months, with the purpose to get a home down there." Neil aims out that acquiring property abroad can be challenging without first experiencing the place.

"It's something that individuals require to be truly diligent about," he says, and suggests deportees to be careful of typical errors, such as overstaying in the United state

Neil is careful to mindful to Stress and anxiety tax authorities tax obligation "I'm not conducting any business any kind of Company. The United state is one of the couple of nations that tax obligations its citizens no matter of where they live, implying that even if a deportee has no revenue from United state

Not known Details About Feie Calculator

tax returnTax obligation "The Foreign Tax Credit score enables people working in high-tax countries like the UK to offset their U.S. tax obligation obligation by the quantity they've already paid in tax obligations abroad," states Lewis.

The prospect of lower living prices can be appealing, however it typically features compromises that aren't promptly obvious - https://www.giantbomb.com/profile/feiecalcu/. Housing, for instance, can be a lot more economical in some nations, however this can mean endangering on infrastructure, safety, or accessibility to reliable energies and solutions. Economical residential properties might be located in areas with irregular net, limited public transport, or undependable medical care facilitiesfactors that can substantially impact your day-to-day life

Below are some of one of the most frequently asked questions concerning the FEIE and other exclusions The Foreign Earned Earnings Exclusion (FEIE) enables united state taxpayers to leave out up to $130,000 of foreign-earned revenue from federal click to investigate earnings tax obligation, reducing their united state tax responsibility. To qualify for FEIE, you need to fulfill either the Physical Presence Examination (330 days abroad) or the Authentic Residence Examination (confirm your primary residence in a foreign country for a whole tax obligation year).

The Physical Visibility Test additionally requires United state taxpayers to have both an international income and a foreign tax home.

Unknown Facts About Feie Calculator

An earnings tax treaty in between the U.S. and another nation can aid prevent dual taxation. While the Foreign Earned Income Exemption lowers gross income, a treaty may supply extra advantages for qualified taxpayers abroad. FBAR (Foreign Savings Account Record) is a required declare united state citizens with over $10,000 in international monetary accounts.

Neil Johnson, CPA, is a tax obligation consultant on the Harness platform and the creator of The Tax obligation Man. He has more than thirty years of experience and now focuses on CFO solutions, equity compensation, copyright taxes, cannabis taxation and separation associated tax/financial preparation issues. He is an expat based in Mexico.

The international made income exclusions, sometimes referred to as the Sec. 911 exemptions, omit tax on earnings gained from working abroad.

See This Report about Feie Calculator

The earnings exemption is now indexed for rising cost of living. The optimal yearly revenue exemption is $130,000 for 2025. The tax advantage leaves out the revenue from tax at lower tax obligation prices. Previously, the exemptions "came off the top" reducing revenue subject to tax obligation at the top tax obligation prices. The exemptions may or might not minimize income utilized for various other functions, such as individual retirement account restrictions, kid credit scores, personal exemptions, etc.

These exclusions do not excuse the earnings from United States tax however simply supply a tax reduction. Keep in mind that a solitary individual functioning abroad for every one of 2025 that earned concerning $145,000 without other income will have taxable earnings minimized to zero - efficiently the same answer as being "tax obligation complimentary." The exemptions are computed every day.

If you went to service meetings or workshops in the United States while living abroad, income for those days can not be omitted. Your salaries can be paid in the United States or abroad. Your company's location or the area where earnings are paid are not consider getting the exemptions. Form 2555. No. For United States tax obligation it does not matter where you keep your funds - you are taxable on your around the world earnings as an US individual.